Family and friends: These folks are more unlikely to care about your credit rating rating and will Offer you superior terms than a standard lender.

As soon as you post all supporting paperwork, your loan will enter the underwriting system. The lender will Verify to you should definitely contain the credit and revenue to repay the loan and ensure other elements of your application.

How does inflation impression my regular of dwelling? The amount of am I expending? How much do I want for emergencies? Should really I spend down credit card debt or invest my month-to-month surplus? How much time will my funds final with systematic withdrawals?

Automobile Financing (Auto Loan): Occasionally, we want a cheap car or truck to receive us about. Most vehicle loans have limits which include calendar year product in the car, mileage, and so forth. These limits can make worries In regards to wanting to use a traditional automobile loan to finance a $six,000 auto. In case you are paying for a more expensive auto and using a down payment, then the quantity financed may only be $6,000.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance policy

Among the finest parts of using out a private loan is that you don't have to disclose every depth of what you intend to do with the money. Other loan styles like development loans, involve rigorous scheduling and need to adhere to an itemized description of wherever every cent is getting invested.

When you are able to receive a charge card, you should use it often and fork out the harmony off in entire on a monthly basis. Just after a while, you should have ample credit score founded to use for an additional bank card or piece of credit rating. This cycle must keep on until finally you may have plenty of credit score to qualify for an unsecured private loan.

When you have negative credit, that you are more likely to get a better curiosity level so that the lender can ensure that it helps make its a refund even if you default to the loan.

Personal loan refinance calculator: Use this calculator to ascertain irrespective of whether refinancing an existing personalized loan makes sense.

Throughout the underwriting process, your lender will do a “challenging pull” of your respective credit history. This may lessen your score, particularly when you've quite a few difficult inquiries in just some months.

Watch our house acquiring hubGet pre-permitted for the mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs obtain calculatorHow Significantly can I borrow mortgage calculatorInspections and appraisalsMortgage lender testimonials

Regular mortgages demand a 3% down payment. They assist you to finance a home truly worth around an once-a-year optimum established by Fannie Mae, a federally-dependent property finance loan organization.

To make use of the calculator, enter the start equilibrium of your loan along with your fascination level. Future, insert the minimum amount and the most that you could shell out each and every month, then simply click calculate. The effects will Allow you see the whole fascination plus the regular ordinary with the bare minimum and maximum payment plans.

There's two Main forms of interest, and it is vital to understand the distinction between the two In terms of calculating here your rate.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Danny Pintauro Then & Now!

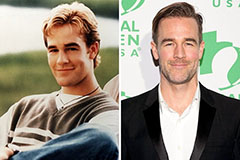

Danny Pintauro Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!